Data-Driven Bidding Strategies for RES Production on Multiple Electricity Markets

Data-driven approach for bidding RES production and storage on multiple electricity markets

Partner: ARMINES

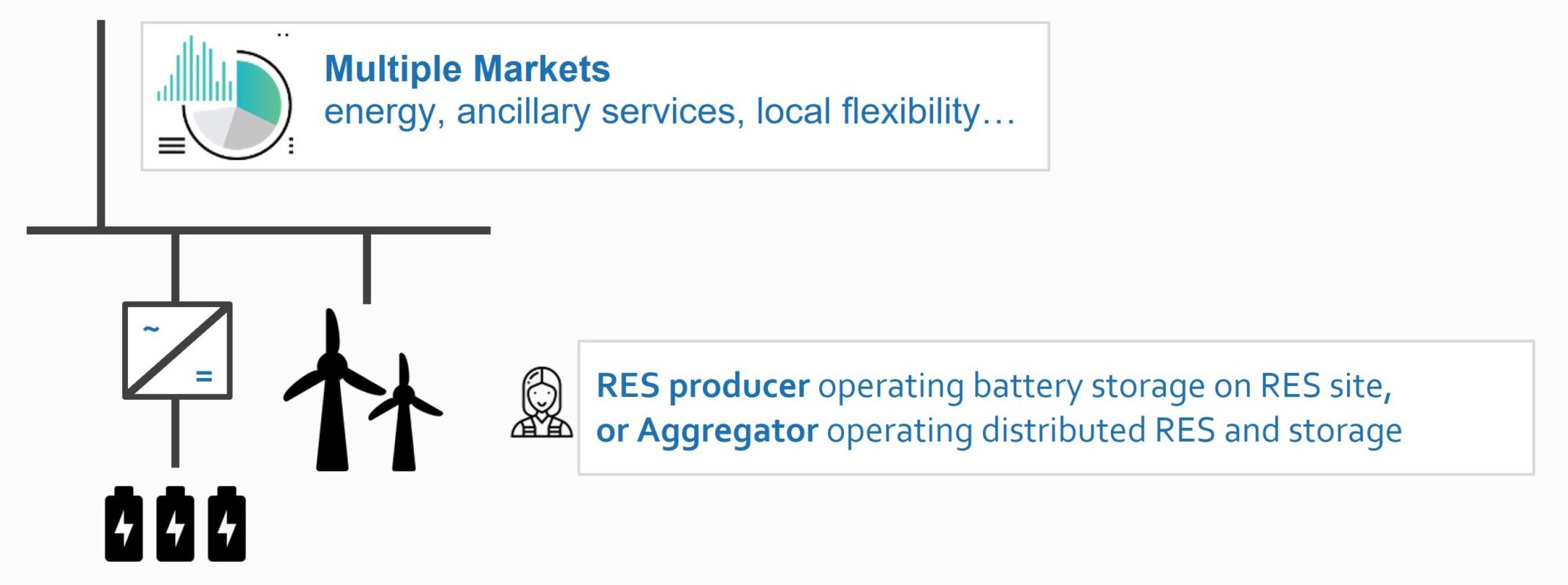

Actors involved: RES producers, Aggregators

Context |

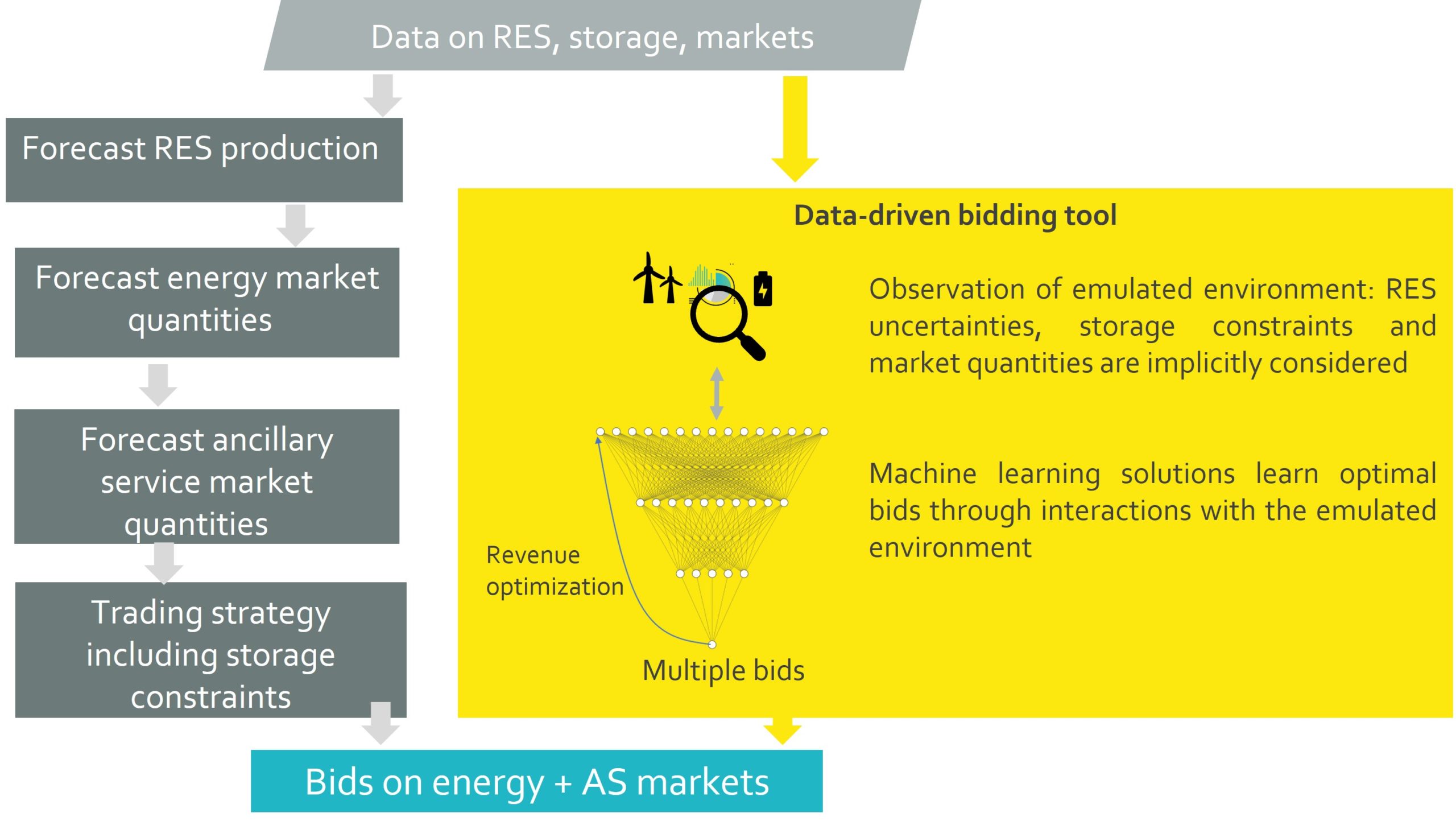

The optimization of bidding strategies for operators of RES plants and storage facilities requires traditionally multiple predictions including RES production, market quantities and possibly grid state at points of connection. Although such predictions provide an information environment to the decisionmaker, having so many predictions represents a cost for operators since predictions are often purchased from third parties and can be source of inefficiency by cumulating forecasting errors.

A data-driven bidding strategy is proposed to simplify bidding on electricity markets for operators of RES plants and storage facilities. It simplifies the modelling chain compared to a classic approach where numerous forecasts such as RES production and market conditions are needed before decision can be made.

By staying one step ahead, the bidding strategy is learnt directly on an objective function computed from the observed production levels and market quantities.

Summary |

The proposed data-driven approach aims at enabling a direct derivation of bids on electricity markets by RES power plants, possibly operated jointly with storage facilities. The approach is thought to be generic, i.e. adaptable to various energy sources (Wind, PV, run-of-the-river Hydro), and capable of integrating storage and its corresponding constraints.

The approach is model-free in the sense that it is optimizing value without imposing specific underlying models on production nor markets. It is developed based on advanced machine learning and tools from operational reserves.

Challenge |

How to optimize the joint operation of RES and storage system and their bidding strategies on electricity markets?

Approach |

A model-free approach is developed with a progressive incorporation of complexity, in terms of approaches for machine learning and optimization. Bidding applications include multiple markets (futures, day-ahead, intraday, besides energy and ancillary services markets).

Innovative content of forecasting solution

The original contributions of this Use Case are:

- Bypass of forecasting models for RES production and market quantities (1 data-driven bidding method instead of 10 or more forecasting models).

- Integration of storage with realistic modelling of associated constraints in a data-driven bidding method.

- Reinforcement Learning has benefits in terms of revenue and avoided large losses due to situations that are hard to predict (including combinations of uncertain events on RES production, markets and grids).

| KPI1 | Reduction of costs from balancing |

| KPI2 | Increase of average revenue |

| KPI3 | Evaluation by traders – analytic approach |

| KPI4 | Evaluation by traders – ‘no big change approach’ |